operating cash flow ratio ideal

Operating Cash Flow Ratio is a key metric for success as a business to measure how much cash a company brings in from assets compared to how much it invests in assets. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

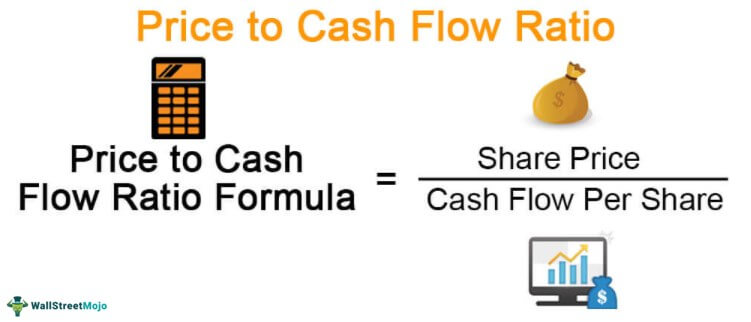

Price To Cash Flow Ratio P Cf Formula And Calculation

The higher the number is the more your business is making.

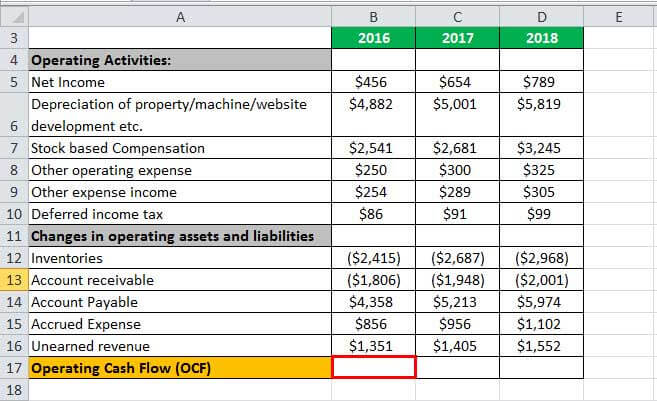

. This ratio can help gauge a companys liquidity in the short with regard to. Operating Cash Flow Ratio Operating cash flow Current Liabilities¹ ². What is Operating Cash Flow Ratio OCF.

If the value stands to be more than one it signifies that the company has enough cash or more cash than the amount required to be paid off as current liabilities. Here is the formula for calculating the operating cash flow ratio. Cash flow from operations average current liabilities operating cash flow ratio.

However there are no ideal cash turnover ratios This is because different companies have different operating styles. Lets take each component individually to understand what number needs to be plugged in. Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you make.

What does a cash turnover ratio show you. Operating cash flow indicates whether a company is able to. Far and above the most valuable liquidity ratio is the operating cash ratio.

Because this value is greater than one it indicates that the company has enough cash. Operating cash flow ratio is an important measure of a companys liquidity ie. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities.

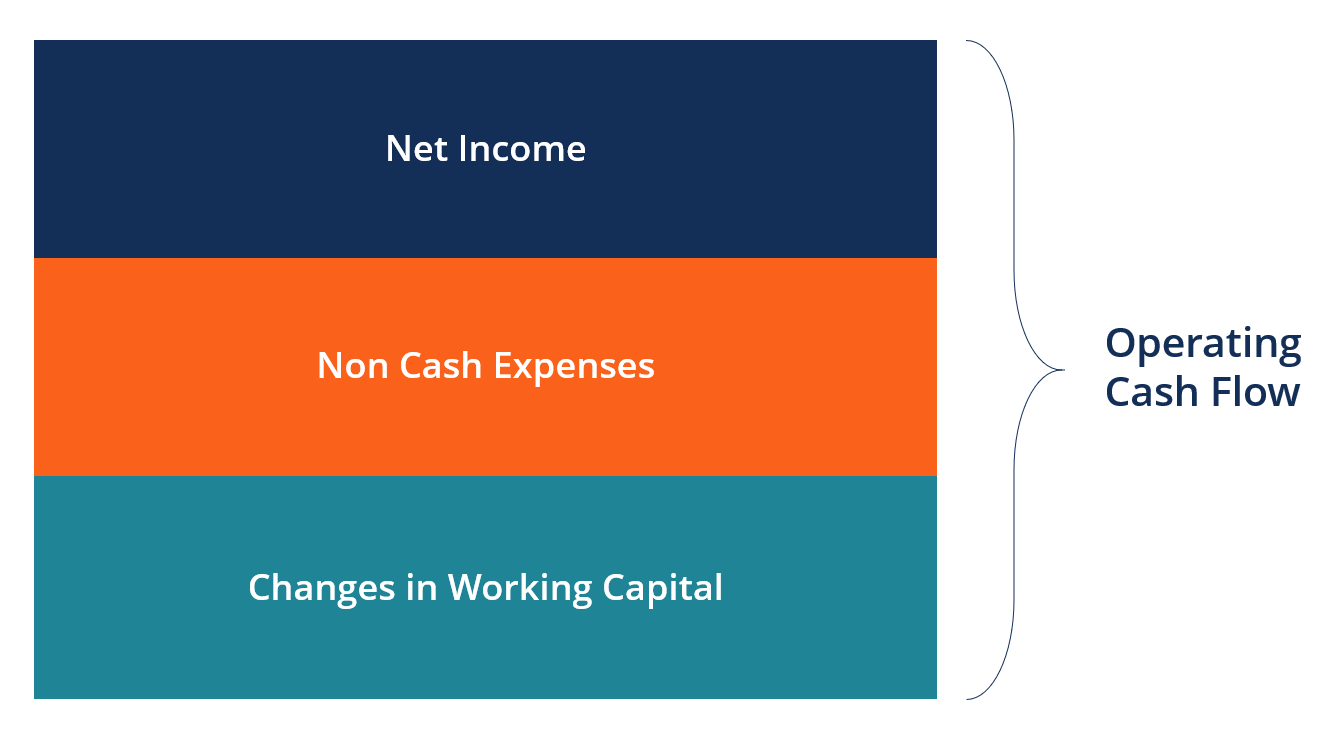

Operating cash flow is the cash generated through a. High cash flow from operations ratio indicates better liquidity position of the firm. It might seem that a smaller business wouldnt need to use.

A ratio smaller than 10 means that your business spends more than it makes from operations. Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. The operating cash flow ratio is a measure of a companys liquidity.

There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations. Operating cash flow is important because it indicates whether a company is able to generate sufficient positive cash flow to maintain and grow its operations or whether it may require external financing. Operating cash flow ratio operating cash flow current liabilities.

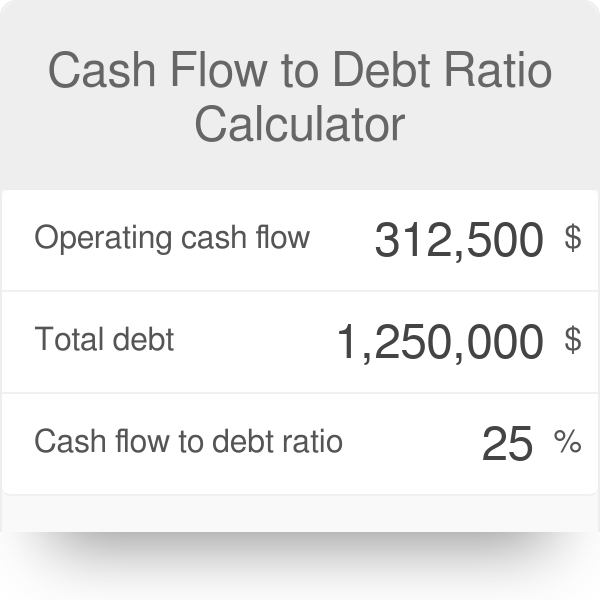

A cash flow coverage ratio of 138 means the companys operating cash flow is 138 times more than its total. In this case the retail company would have a cash flow coverage ratio of 138. Operating Cash Flow - OCF.

The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. Operating cash flow Net cash from operations Current liabilities. Operating cash flow ratio 14.

The operating cash flow ratio tells the number of times a firm can manage paying off its current liabilities using cash within the same time. It should be considered together with other. Operating Cash Ratio Formula and Understanding.

A higher ratio is better. We can apply the values to our variables and calculate the cash flow coverage ratio using the formula. Its ability to pay off short-term financial obligations.

Operating Cash Flow Ratio. Operating cash flow ratio 140000 100000. The OCF ratio lets you know if you are prepared to cover your expenses and how much cash you have on hand for any short-term needs.

However if the operating cash flow. In accounting it is a measure for amount of cash generated by a companys normal business operations. The operating cash flow OCF ratio is the measure of money earned and spent by your business.

This may signal a need for more capital. It measures the amount of operating cash flow generated per share of stock. This is a simple enough ideawith powerful results.

Ideally a good cash turnover ratio is one that gets smaller depending on the company. Operating Cash Flow. High Low Operating Cash Flow Ratio.

Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow. The operating cash flow. Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet.

A Guide to Liquidity With Definitions Distinctions Formulas and Examples Cash flow coverage ratio. The formula is. This ratio is generally accepted as being more reliable than the priceearnings ratio as it is harder for false internal adjustments to be made.

The operating cash flow ratio is a measure of how readily current liabilities are covered by the notes flows generated from a companys operations. Its primary element the numerator in this formula is. The operating cash flow ratio indicates if a companys normal operations are sufficient to hide-out its near.

The cash turnover ratio shows you how many times the company can make a complete cycle of cash flow. By using the formula the financial analyst finds that the company has an operating cash flow ratio of 14. Thus investors and analysts typically prefer higher operating cash flow ratios.

So a ratio of 1 above is within the desirable range. An Operating Cash Flow Ratio is an accounting ratio that shows the amount a company uses for ongoing operations divided by its operating cash flow adjusted for non-recurring itemsThe Operating Cash Flow.

Cash Flow To Debt Ratio Meaning Importance Calculation

Operating Cash Flow Ratio Definition Formula Example

Price To Cash Flow Ratio Formula Example Calculation Analysis

Price To Cash Flow Formula Example Calculate P Cf Ratio

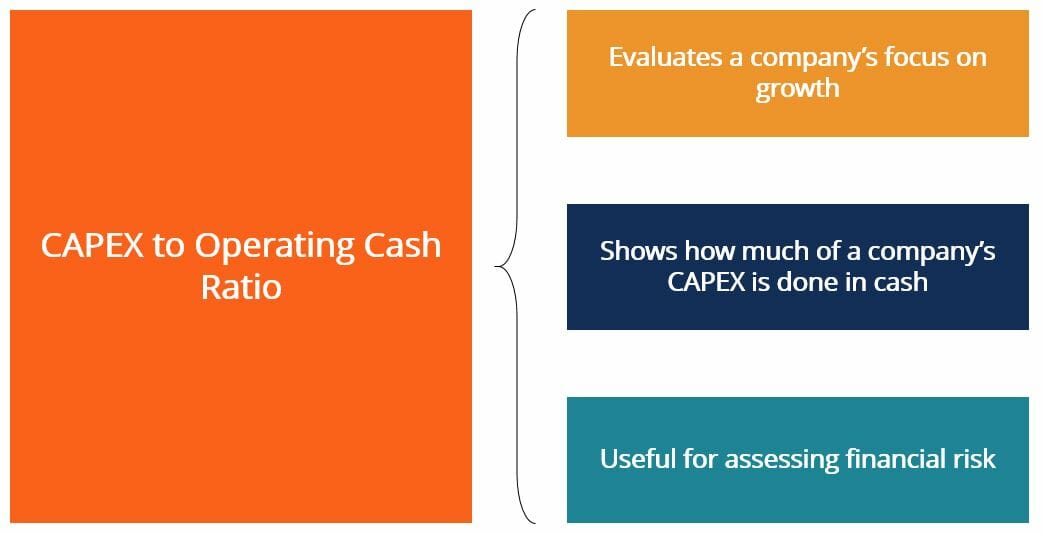

Capex To Operating Cash Ratio Definition Example Corporate Finance Institute

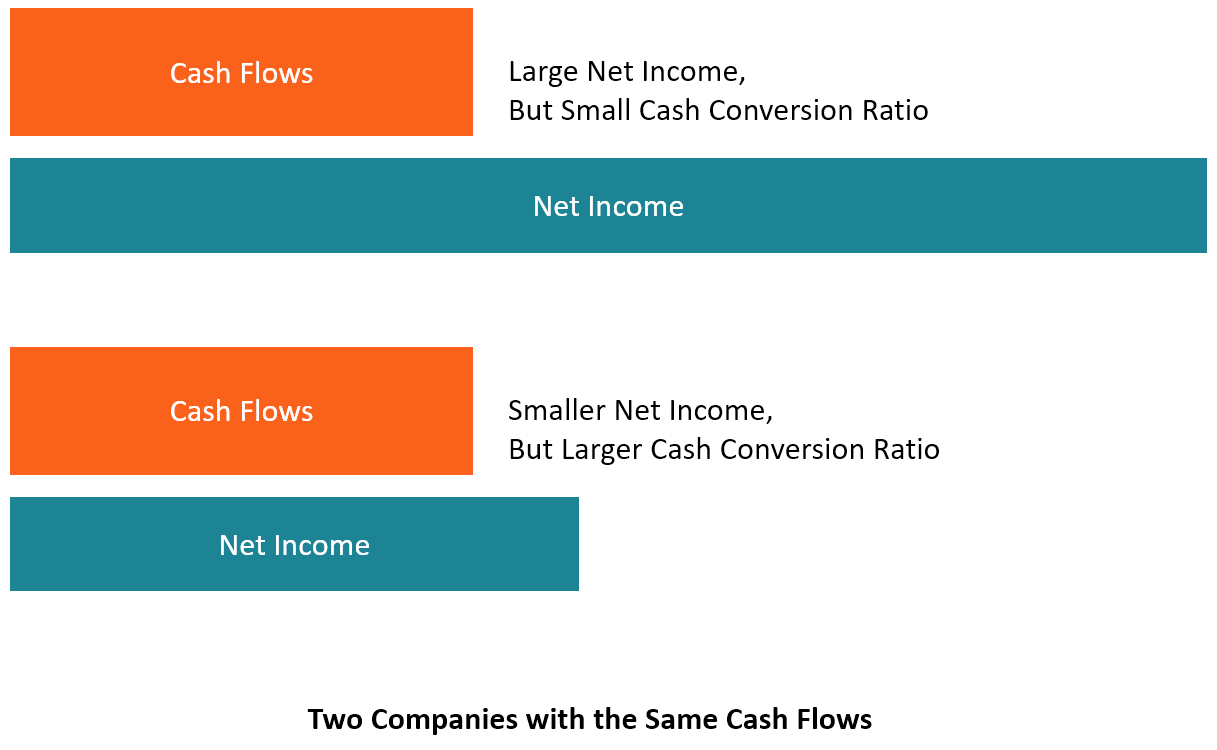

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Operating Cash Flow Formula Overview Examples How To Calculate

Operating Cash Flow Formula Calculation With Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio

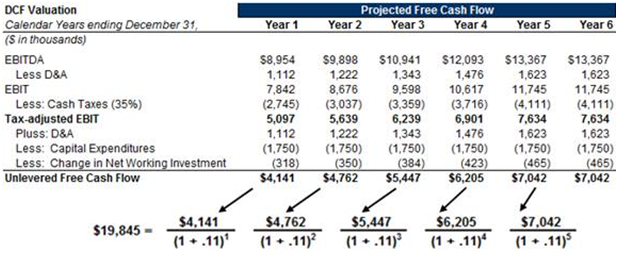

Free Cash Flow Formula Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Calculator

Cash Flow To Debt Ratio Calculator

Operating Cash Flow Ratio India Dictionary

Cash Flow Formula How To Calculate Cash Flow With Examples